Africa’s Renewable Energy Opportunity Is Vast... and Growing.

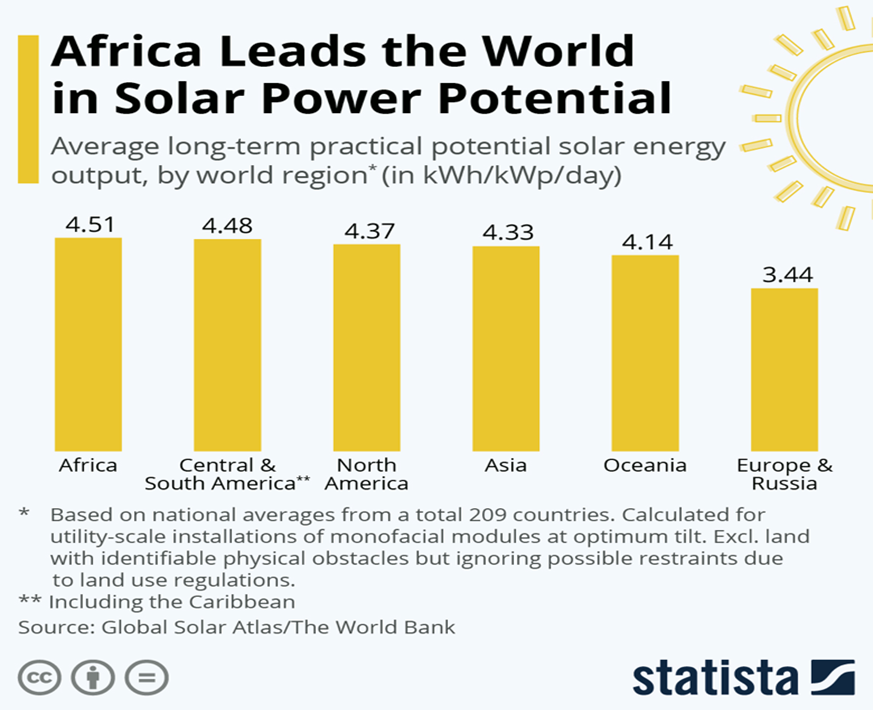

In the face of growing environmental concerns and mounting pressure to shift towards renewable energy sources, African renewable energy has become a growing focus- with a noticeable trend over the last 18 to 24 months: large international groups outside Africa investing heavily in African solar energy firms that provide solutions to commercial and industrial (C&I) clients as Africa leads the world with solar power potential.

The move to invest in African solar companies can appear to be a step in the right direction as they imply a willingness to invest in cleaner energy for the continent, however, by acquiring renewable energy companies, these large corporations may be seeking to greenwash their image rather than genuinely embracing a cleaner, more sustainable future.

One argument in favour of these deals is that they bring much-needed capital and resources to smaller renewable energy companies, helping them to scale up operations faster. While this may be true, the infusion of big money can come with corporate influences that can potentially stifle the innovative and agile spirit of these smaller firms. Will these companies retain their core values, cutting edge innovation and entrepreneurial spirit that has allowed them to grow in competitive African markets? Are solutions to the Africa’s unique power problems most likely to come from African companies or multi-nationals that invest in African companies?

Pros:

- Access to Capital: Oil giants possess substantial financial resources, which can be leveraged to accelerate the growth and scalability of renewable energy projects. This influx of capital can fund research and development, expand infrastructure, and drive innovation.

- Infrastructure and Expertise: Established oil companies have extensive experience in project management, logistics, and operations. Leveraging existing infrastructure, such as refineries and distribution networks, can streamline the transition to renewable energy and enhance project efficiency.

- Market Expansion: Merging with or acquiring smaller companies enables oil giants to diversify their portfolios and access new markets. This strategic expansion into renewables can mitigate risks associated with volatility in the oil market and position companies for long-term growth in the expanding clean energy sector.

- Transition to Sustainability: Collaboration between oil companies and renewable energy firms facilitates the transition towards a more sustainable energy future. By combining resources and expertise, companies can accelerate the deployment of renewable technologies, reduce carbon emissions, and contribute to global efforts to combat climate change.

Cons:

- Greenwashing Concerns: Critics argue that such mergers may be driven more by public relations and greenwashing tactics than genuine commitment to sustainability. There is scepticism regarding the sincerity of oil companies’ intentions and their ability to prioritize clean energy over fossil fuels.

- Conflicting Interests: The core business models of oil companies and sustainable energy firms often differ significantly, leading to potential conflicts of interest and diverging priorities. Oil companies may prioritize profit margins and shareholder returns over environmental sustainability, raising concerns about the long-term viability of such projects.

- Cultural Misalignment: These mergers may encounter challenges related to cultural differences and organizational dynamics. The values and ethos of traditional oil companies may not align with the environmental ethos and sustainability-focused culture of renewable energy startups, leading to integration challenges and employee morale issues.

- Risk of Stifling Innovation: Some fear that consolidation within the renewable energy sector, driven by mergers and acquisitions with oil giants, could stifle innovation and competition. Smaller, innovative companies may face barriers to entry and limited access to market opportunities, hindering the development of new technologies and solutions.

Only time will tell how all of these moves will shake out, but one things that remains is, each C&I client faces unique power challenges to their operations. Each market has its own regulatory challenges that can affect scaling of solar PV. Power issues in Africa are also extremely complex, the power reliability and quality currently being provided to Industry is generally very poor, thus necessitating out of the box thinking and careful design considerations that go far beyond simple solar PV- a “rapid scale on the level of Uber” approach will not work.

Our aim at Ariya Finergy is to be the Power Partner for our clients for the long-term over the life of any project; therefore, to-date we have made a concentrated effort to grow in markets where our strong engineering, deep battery experience and knowledge of local operating environments means we can match the solutions to the clients’ needs. Will we join the trend and merge with another EPC or actively pursue outside investment? Ariya will continue to innovate, expand and smartly grow our portfolio by the quality of work that we deliver… and maybe the right partner will show up!

Our continued focus will be on thoughtful execution and measured growth. By aligning each initiative with sound engineering principles and a long-term perspective, we aim to create solutions that remain effective and relevant as market conditions evolve. This approach ensures that our work is not only technically robust but also positioned to support sustainable progress for years to come.

To see how our innovative solutions are helping businesses across East Africa with their energy needs, look at our projects, view our client feedback, or contact us today to let us walk the journey to a greener economy with you.